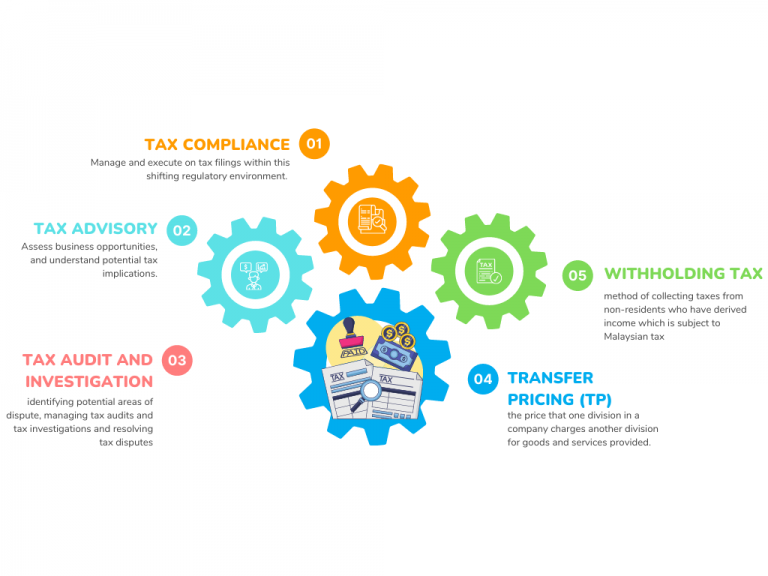

Taxation

Our tax services are designed to help clients to integrate into today’s competitive business as well as fiscal environment through effective tax planning and maximisation of tax incentives while maintaining regulatory compliance. We offer a whole range of professional tax services align with the government’s self-assessment system.

Tax Compliance

Our team of experienced professionals are ready to assist clients in the area of tax compliance. Our team is committed to continuous professional development so that they are equipped to inform clients with the most updated tax knowledge when preparing the various returns under the present self-assessment system regime.

Our services cover:

- Tax filing compliance (Company, Enterprise and Individual)

- Application for tax refund

- Incentive / Exemption review

- Application for Certificate of Residence

- Withholding Tax Compliance

- Other tax compliance services

Tax Advisory

In the rapid changing tax legislation environment under the self-assessment system, it is important that companies are aware of the various potential tax benefits made available by the government and the availability of alternative business or tax solutions. We aim to excel in the area of tax planning to minimise the cost of doing business and therefore, optimising business competencies as well as efficiencies.

Our services cover:

- Specialist tax advisory services (e.g. Merges & Acquisition, Business Restructuring)

- Application for tax incentives (e.g. Pioneer status, Investment Tax Allowance)

- International tax planning

Tax Audit And Investigation

In the event of a field audit, if the field audit officer is not satisfied with the result of field audit, they will refer the cases to the tax investigation unit of the IRB. With our experience, we are able to provide support in dealings with the IRB’s investigation officer and assist the client in resolving the issues raised in the process. We also take directives from the clients to negotiate a settlement over these investigations. This will lead to the issuance of a composite assessment in most instances.

Our services cover:

- Assist in liaison with the Inland Revenue Board Malaysia (IRBM)

- Negotiation with the IRBM on settlement of audit or investigation cases

Transfer Pricing (TP)

The Inland Revenue Board of Malaysia (IRBM) introduced TP Guideline 2012, in line with the introduction of transfer pricing legislation in 2009 under Section 140A of the Income Tax Act 1967. With effect from year of assessment 2014, taxpayers are required to indicate in the income tax return (Form e-C) whether they have prepared transfer pricing documentation. This shows that the IRBM places increasing focus on transfer pricing matters. Our professional team can assist your company in supporting pricing used in related party transactions and advice on documentation requirements.

Our services cover:

- Transfer Pricing analysis, advisory and planning

- Transfer Pricing documentation

- Transfer Pricing audit defence

Withholding Tax

In Malaysia, we have seen the growth and potential of e-commerce as a new business channel. The development of e-commerce has been accelerated by Covid-19 pandemic lockdowns , which created new customer bases while pushing many businesses to go online. Evidently even traditional businesses need to take initiatives in using technology such as social media marketing, cloud-based accounting software and so on. Thus, IRBM has announced expanding withholding tax to be required under e-commerce industry, which includes services performed by foreign providers outside Malaysia.

Our tax experts will assist in handling withholding tax which is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax. Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to IRBM within one month of paying or crediting.

Our services cover:

- Withholding tax assessment and compliance review

- Withholding tax consultancy

- Withholding tax calculation and submission

Other Tax Services

Our tax experts will advise on tax due diligence which is essentially a risk review of a company’s tax position and its exposure to potential and uncrystallised tax liabilities. It focuses on assessing risk to ensure that the acquirer is getting what he thinks he’s getting without undisclosed facts and information. It is particularly important as tax is a substantial cost of doing (or buying into) any business. The findings from a tax due diligence exercise would eventually be used to support the sale and purchase negotiations of the company. Other than that, our professional tax team will also assist in advisory and compliance services for indirect tax, which includes Stamp Duty application and Real Property Gains Tax. We will help you to identify risk areas and sustainable planning opportunities for indirect taxes throughout the tax life cycle, helping you meet your business goals. Furthermore, our tax professionals can also assist in expatriate tax clearance application to IRBM that indicates any outstanding income tax by the employee, regardless if they are local, foreigner or expatriate. Lastly, since Malaysian regulators, IRBM adopt taxation principle, income earned in Malaysia is taxable. Income tax submission/tax return must be made even for expatriates: those who work in Malaysia for more than 60 days but less than 182 days (Non Resident) are eligible to pay taxes at 30% tax rate. Expatriates who fall under Resident status are eligible for tax deductions.

Connect With Our Experts:

Mr Chen Voon Hann

Managing Partner

vhchen@cas.net.my

Ms. Shameera Dewi Binti Redzwan Shah

Senior Manager

shameera@cas.net.my