Business Advisory

Constant legislative changes, consolidations of businesses, as well as stiffer competition and pressure to improve value to shareholders can have a significant impact to an entity’s competitive edge in the marketplace. It is within this volatile environment that we believe we have put ourselves in a place of maximum potential to serve our clients, especially those from the small and medium industry sectors (SMI) as well as emerging enterprises.

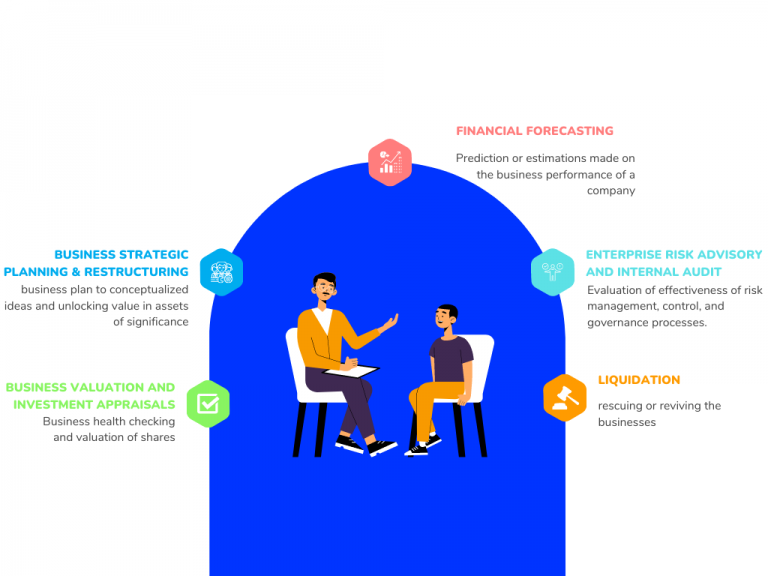

Business Strategic Planning & Restructuring

Whether for application for funding or for submission for initial public offerings on the ACE Market or Main Market of Bursa Securities Berhad, a comprehensive business plan is a must. It is not always easy for a company’s management team to put on paper their conceptualised ideas. We have extensive experience in helping management to draw up an integrated business plan that can show the investment and cash flow position on a realistic basis. This will enable the user of such report to decide on the merit of fundings as well as the potential for growth of the business. A good business plan is a blueprint for a company to chart their growth from strength to strength.

One of the corporate buzzwords nowadays is business re-engineering. It compels the managers to look at their business operations to ensure that the operations contribute towards achieving the company’s broader strategy. In the event that it doesn’t, a restructuring process is usually undertaken. In other cases, corporate restructuring is also undertaken to “unlock” value in assets of significance. Here at CAS, a comprehensive service of this nature is available which combine our senior team’s broad commercial exposure with an acute understanding of the present tax regime, an area that normally gets neglected during the restructuring process.

Business Valuation And Investment Appraisals

Business valuation need to be conducted in the buying and selling process to check on the business health. Our experts will assist in identifying the valuation through various approaches such as referring to past transactions, market price comparisons, cashflow models or other methods. Business valuation also helps businesses to identify what to improve. Other than being needed in the buying and selling process, business valuation is applicable when an investor wishes to sell his shares in a company;, an assessment of fair value is required for any dispute; a fair value is required for accounting purposes; and when unique assets have to be valued for business purposes, e.g. intellectual property or computer software.

Our key experts also assist businesses that seeks to identify the attractiveness of a potential investment or project, which we will conduct through various types of capital budgeting and financing techniques. Our service of investment appraisal will assist investors that wish to conduct a fundamental analysis which help in identifying long-term trends and the potential company’s profitability before deciding to invest. We would advise clients to weigh the risks, especially when the company is mostly involved in numerous long-term projects which may may affect revenue, costs and cashflows.

Financial Forecasting

Financial forecasting is the future prediction or estimations made on the business performance of a company. Various methods or forecasting can be used to identify business performance in future, such as prediction of company’s revenue. Revenue forecasting helps to identify the company’s position and indicates whether the company is good in their decision-making process and meeting the company’s objectives. Historical data will be used to make these predictions. We will assist you to determine how to spread your resources, setting objectives and budget, and identify expected expenditure through financial forecasting. For new businesses, financial forecasting aids in understanding business model for making projections in future, helps identify uncertainties in meeting financial smart objectives, plans to mitigate risks that might disrupt company’s growth and utilise opportunities to improve cash flows and increase the company’s profitability.

Strategic Partnership

Business players in every industry are facing challenges of maintaining their business visibility which have been greatly impacted by capital scarcity, shortage of top talents and difficult economic conditions that have been exarcebated by the Covid-19 pandemic. This is when business players might want to seek out strategic partnerships to combine resources — finance, skills, information and/or other resources — by forming a formal bilateral agreement or even network partnership to achieve common goals. Strategic partnerships enable businesses to have new revenue growth, more risk-averse strategies and to overcome financial constraints. Our experts will assist you in navigating common issues and pitfalls during the partnering process. The common issues that may arise include building and preparing strategies, structuring process, negotiation to achieve one solution/ planning that is agreed by both parties, and implementation process. Our team will support the strategic partnership process by unlocking cost savings and/or revenue opportunities, avoiding regulatory blockages and unexpected or unnecessary disputes, with the objective of delivering value in the longer term.

Mergers And Acquisition

Different from strategic partnership, mergers and acquisition is a process whereby companies or asset seeks to consolidate through various types of financial transactions, including mergers, acquisitions, consolidations, tender offers, purchase of assets, and management acquisitions. Our experts will provide solutions in the merger and acquisition process by dealing with terms and the effects they may have on the accounting for business combinations and how to avoid unintended accounting consequences when bringing two businesses into one. It is important that management is aware of the financial reporting consequences of putting in place certain terms and conditions into sale and purchase agreements. Other than that, our team will also assist in assessing the necessity for push-down accounting and distinguishing between equity and cost method investments.

Enterprise Risk Advisory

We are in the business of helping our clients to manage their risks as well as identify areas for possible operational improvement. Through our immaculate understanding of our clients’ businesses, we can help to position them to tap into opportunities as they arise through the business cycle. We believe this will bring about improvement in our clients’ efficiencies and profitability. Our objective is to add maximum sustainable value to all the activities of the organisation. We marshal the understanding of the potential upside and downside of all those factors which can affect the organisation. We increase the probability of success, and reduce both the probability of failure and the uncertainty of achieving the organisation’s overall objectives. We integrate into the culture of the organisation an effective policy and a programme led by the competent senior management. We translate the strategy into tactical and operational objectives, assigning responsibility throughout the organisation with each manager and employee responsible for the management of risk as part of their job description. This supports accountability, performance measurement and reward, thus promoting operational efficiency at all levels.

Internal Audit

We cater to the needs of clients who wish to outsource their internal audit function. The skills of our team in this division is invariably strengthened through their exposure to various industries as well as their attention to details. Internal audit is important in directing business to accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes (Institute of Internal Auditors, 2019). We will assist you to evaluate the key risks that the company may be facing and devise solutions to mitigate the risks in an effective manner by working interdependently with all levels. The efficiency of management policies will be evaluated by assessing the tone and risk management culture. Our experts also will aid in analysing the operating procedures by working closely with you to review operations and report findings. Lastly, our professional team will provide assurance by working together with the audit committee members in your organisation to ensure that available assurance resources are being optimised.

Liquidation

Adapting to an ever-changing environment is a great challenge to business owners these days, especially businesses that are heavily impacted by Covid-19. A business may go into a downturn, and rescuing or reviving the businesses may be difficult and only cause distress for the concerned parties. This is when management might conclude to opt for liquidation as the best and least painful option. whether by members or creditors voluntarily. Liquidation might occur by court order as well.

Connect With Our Experts:

Mr. Jeremy Kong June Hon

Managing Director

jeremy.kong@cas.net.my

Mr. Chen Voon Hann

Executive Director

vhchen@cas.net.my